Some mortgage rates cut below 4% as competition picks up

Adapted from BBC Article by Kevin Peachey, Cost of living correspondent 13 February 2025

Two major lenders launched mortgage deals on Thursday with interest rates of less than 4%, as competition picks up in the sector.

The prospect of further cuts in the base rate by the Bank of England has given mortgage providers confidence to reduce their own rates.

But the attention-grabbing sub-4% deals by Santander and Barclays will not be available to all borrowers, particularly first-time buyers, and may come with a hefty fee.

The return of such deals might prompt other lenders to follow suit after a period of tepid competition.

Nationwide, the UK's biggest building society, has said it will reduce some of its rates on Friday.

Mortgage deals with interest rates below 4% have not been seen since November.

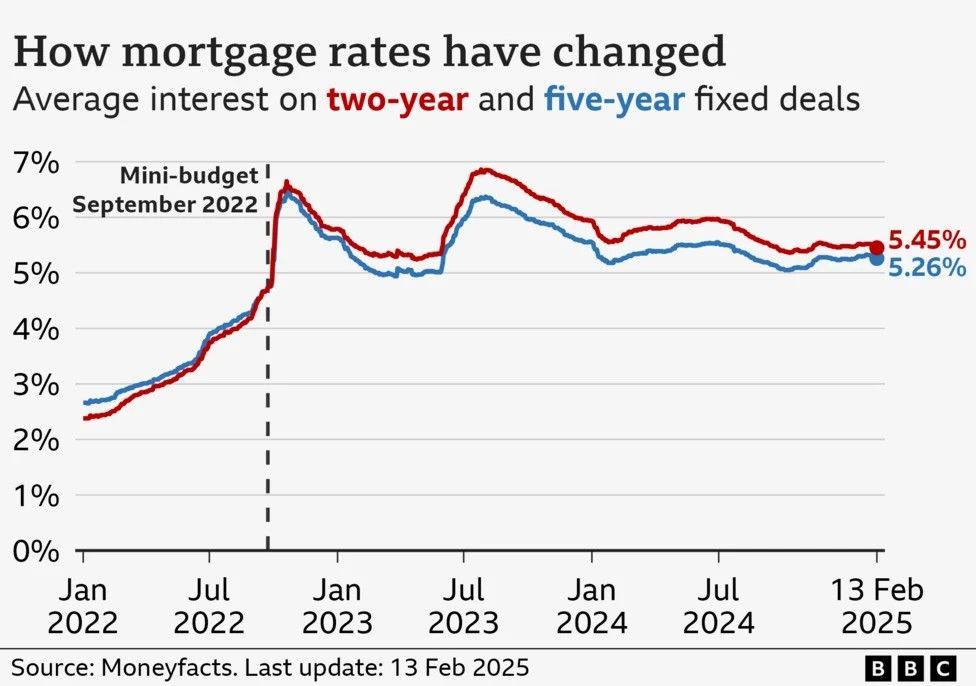

Across the whole market the average rate on a two-year fixed deal is 5.48%. The typical rate on five-year deals is 5.29%, according to latest figures from Moneyfacts.

Time to decide

Some tracker and variable rate mortgages move fairly closely in line with the Bank's base rate, which was cut to 4.5% a week ago. However, more than eight in 10 mortgage customers have fixed-rate deals.

The interest rate on this kind of mortgage does not change until the deal expires, usually after two or five years, and a new one is chosen to replace it.

About 800,000 fixed-rate mortgages, currently with an interest rate of 3% or below, are expected to expire every year, on average, until the end of 2027.

That means a higher monthly bill for many homeowners on their next renewal, but there are signs that the rate they could pay is on its way down.

Bank of England governor Andrew Bailey said the interest-rate setting committee expected to be able to cut rates further "but we will have to judge meeting by meeting, how far and how fast".

This will affect savers who are seeing lower returns, but could bring better news for borrowers. The Bank's next rates decision is on 20 March.

Message from Phil Clark

“Regardless of whether you are a First-time Buyer, Looking to move, remortgage or invest in property, there are a huge range of competitive mortgage deals on the market. I will be delighted to discuss your specific requirements and offer you the most suitable deal!”

Please call Phil on 0117 3251511 or email info@swmortgages.com

For more information about Mortgage and Protection please visit www.bristolmortgagesonline.com