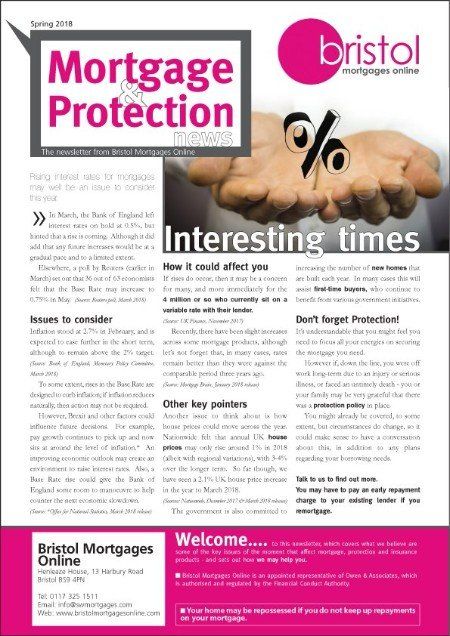

Our latest Issue of “Mortgage & Protection News”

Issue 3 packed full of interesting facts to make sure you are getting the best advice.

Welcome to Issue 3 of our latest newsletter. Please click on the image or link to view or download your FREE copy.

Hot topics in this edition include

- Consider the implications of possible interest rate rises in the Bank of England Base Rate.

- After a long period of very low rates on mortgage deals, it seems that there is already a slight increase on some products.

- Many of the current deals are still at a better rate than they were three years ago.

- A record number of homeowners who remortgaged this January - the highest monthly figure since November 2008!

- How important it is to come to us for professional advice to help navigate you through the massive array of lenders, product choices, affordability criteria.

- The peace of mind brought about by having suitable protection cover in place, should the unexpected occur.

- We look at how Income Protection could deliver a regular income stream should you be off work for a long period due to illness or injury.

- Positive developments working in favour of First-Time Buyers, it’s probably no surprise that the number of first-time buyers in 2017 was the highest figure since 2006!

We hope you find the issue of interest and, once you’ve had a chance to look through, please recommend to friends, relatives or work colleagues, if you think it may be relevant to them too - or we can send them their own copy please send details to info@swmortgages.com .

#mortgage&protection newsletter

#mortgagebrokerBristol

#greatmortgageadvice

#freenewsletter

#greatmortgageadvice