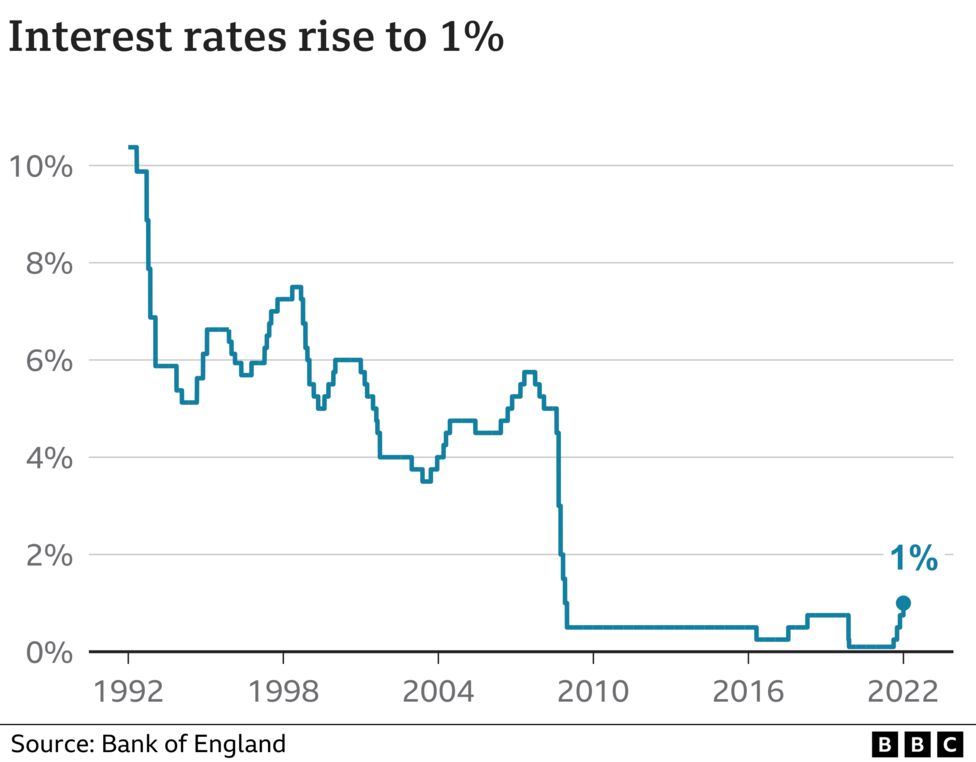

UK interest rates rise to the highest since 2009

Adapted from a BBC News article By Daniel Thomas

Interest rates have risen to the highest level since 2009 as the Bank of England tries to stem the pace of rising prices. Rates rose to 1% from 0.75%, the fourth consecutive increase since December.

Inflation, already rising at its fastest pace for 30 years, is expected to breach 10% by the end of the year, with fuel, energy and food costs soaring partly due to the Ukraine war.

The Bank also warned that the UK economy is set to shrink next year. It said inflation had "intensified" following Russia's invasion of Ukraine, prompting households to rein in their spending which was hitting growth. The Bank raised interest rates again to try and counter this, the fourth time it has increased them since December, as it seeks to contain the rising cost of living. Raising rates makes it more expensive for consumers and businesses to borrow. The idea is this helps cool demand for goods and services, thereby taming prices.

But economists have warned rate rises may have little effect given the rising global oil and gas prices. The Bank's Monetary Policy Committee (MPC) - which sets rates - also acknowledged there were "risks" in raising rates and said it would continue to review "incoming data".

In its latest report, the Bank predicted inflation would now hit 9% in the coming months - up from a previous forecast of 8% - and breach 10% by the end of the year. It said the impact of the Ukraine war on household energy prices were largely to blame, following the increase in the energy price cap in April and a further expected increase in October which could push household bills up to £2,800 a year. Consumers are also facing much higher prices for food, goods and services, it said.

How high could UK interest rates go?

"Global inflationary pressures have intensified sharply following Russia's invasion of Ukraine. This has led to a material deterioration in the outlook for world and UK GDP growth," the MPC said.

"UK GDP growth is expected to slow sharply over the first half of the forecast period," it added. "That predominantly reflects the significant adverse impact of the sharp rises in global energy and tradeable goods prices on most UK households' real incomes and many UK companies' profit margins."

The MPC now expects the UK economy to contract by 0.25% in 2022, down from its previous forecast of 1.25% growth. While that would not technically be a recession - defined as two consecutive quarters of contraction - it would leave the UK at a real risk of one. The MPC has also slashed its growth outlook for 2023 to 0.25%, down from 1%.

It is essential that you look at your current mortgage and that it meets your needs please see our recent blog www.bristolmortgagesonline.com/is-now-a-good-time-to-remortgage

The team at Bristol, Bath and Exeter Mortgages Online will be delighted to answer any queries regarding your current mortgage and will explore the whole of the market to find you the most competitive and suitable deal.

Contact Us

For further details about the services we offer as a fully independent mortgage brokers or any other mortgage information book your FREE CONSULTATION with one of our expert Mortgage Advisers, please contact us

Bristol Mortgages Online www.bristolmortgagesonline.com Tel 0117 325 1511

Bath Mortgages Online www.bathmortgagesonline.com Tel 01225 584 888

Exeter Mortgages Online www.exetermortgagesonline.com Tel 01392 690 888

Email info@swmortgages.com

#bristolmortgagebroker #bestmortgageadvice #bristolmortgageadviser,#expertmortgageadvice

#independentmortgagebroker #bestmortgagedeals #firsttimebuyermortgage #bestremortgagedeal

#freemortgageconsultation #bestmortgagebroker #buytoletmortgage #investmentmortgage

#hmomortgage #highlyratedmortgagebroker #fivestarrated #googleverified #movetobristol

#endoffixedterm #besttimetoremortgage