Boost to buying power from changes to affordability tests

Adapted from Zoopla’s April 2025 Housing report

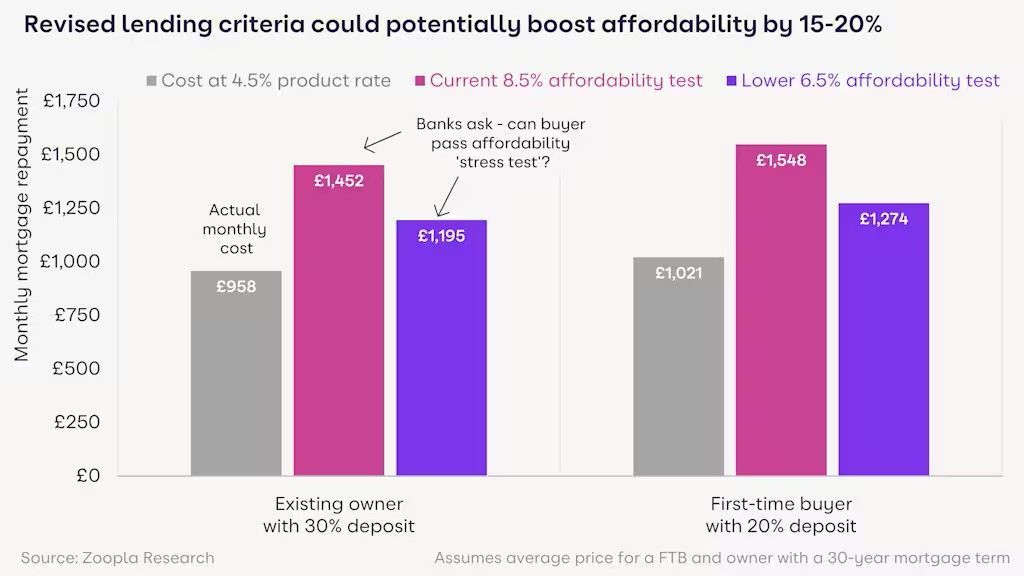

Image: The analysis uses average house prices from the house price index and for first-time buyers to assess mortgage payments at different mortgage rates applied to a 30- year mortgage, at different loan-to-values.

One emerging trend that we expect to positively support market activity in the coming months is a relaxation in how lenders assess the affordability of new mortgages. While buyers focus on the mortgage rate they will pay, lenders also check whether the borrower can afford a 'stressed mortgage rate' at a higher level than the borrower will pay.

While the average 5-year fixed rate mortgage is around 4.5% today, many lenders are currently 'stress testing' affordability at 8-9%. This makes it harder to secure a mortgage without a large deposit. If average mortgage stress rates were to return to pre-2022 levels of 6.5% to 7%, this would deliver a 15-20% boost to buying power.

An average first-time buyer with mortgage repayments of £1,020pcm at a 4.5% mortgage rate would typically have to prove they could afford monthly repayments of £1,550pcm at an 8.5% stress rate. If the stress testing is relaxed to 6.5%, repayments would fall to £1,275pcm, boosting buying power. It's a similar pattern for the average homeowner, while the actual impact will vary by lender and type of borrower.

This change would consequently supporting demand and sales volumes, helping to clear the stock of homes for sale, rather than boosting house prices. Other existing rules and regulations that remain in place will continue to impact the availability of mortgage finance.

Comment from Phil Clark

“This is potentially very exciting news and will give borrowers a greater choice of products if these rules are relaxed.

Regardless of whether you are a First-time Buyer, Looking to move, remortgage or invest in property, there are a huge range of competitive mortgage deals on the market. I will be delighted to discuss your specific requirements and offer you the most suitable deal!”

Please call Phil on 0117 3251511 or email info@swmortgages.com

For more information about the Mortgage and Protection products we offer, please visit www.bristolmortgagesonline.com

Your home/property may be repossessed if you do not keep up repayments on a mortgage or other debt secured on it.