What is an offset mortgage?

Let Us Help You Weigh Up the Benefits

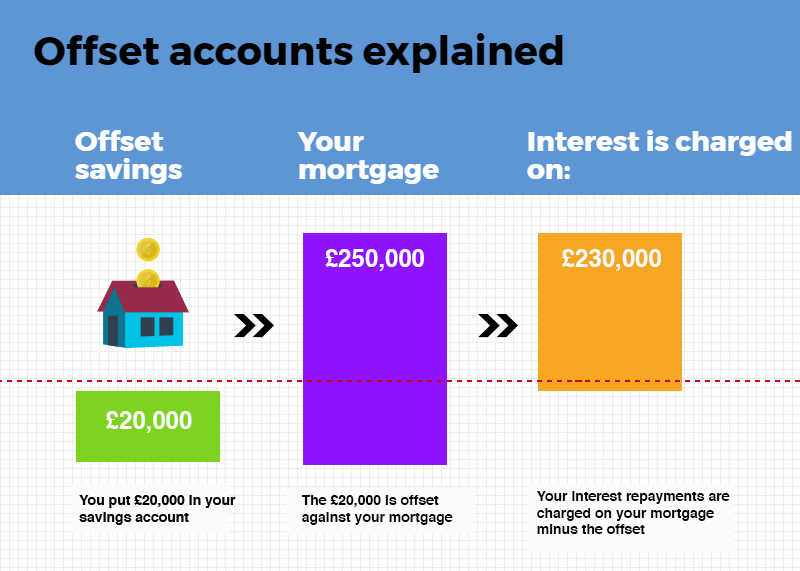

An offset mortgage links your mortgage to your savings account. The value of your savings is deducted from the amount you pay interest on, which lowers your monthly payments.

With an offset mortgage, you will not earn interest on your savings. However, because people usually pay more interest on a mortgage than they earn from a savings account, an offset mortgage could still save you money.

How do offset mortgages work?

An offset mortgage doesn’t affect the value of your savings. Instead, they’re placed in an interest-free savings account and their value is ‘offset’ against your mortgage.

This means that if you have £20,000 in savings, and a mortgage worth £150,000, you’ll only pay interest on the remaining £130,000.

With an interest rate of 5%, this reduces your payments from £7,500 to £6,500 – a saving of £1,000.

However, because you’re no longer making interest on your savings, you’ll need to factor this in to the total amount saved. So if you were earning 1.5% interest on that £20,000, or £300 a year, the total amount saved on your mortgage will come to £700.

Can I still withdraw money from an offset account?

You can still withdraw money from your savings account with an offset mortgage. However, if you take money out of your savings, it will no longer offset your mortgage, and your monthly payments will go up.

You may also need to keep a minimum balance in your savings account. It’s a good idea to make sure you know if there’s a minimum balance requirement before picking an offset mortgage deal.

Is it quicker to pay off my mortgage with an offset account?

With an offset mortgage, you can also choose to pay the ordinary interest rate every month – but because some of the money you owe is offset by your savings, you’ll be effectively overpaying on your mortgage. This means that the amount you owe will go down faster, and your mortgage will be paid off more quickly.

Other types of mortgage might also allow you to overpay, but with an offset mortgage the money remains in your savings account, so you can access it whenever you need to.

Offset mortgage rates

As with standard mortgages, you can get both fixed and standard variable interest-rate offset mortgages.

Fixed-rate deals usually offer a better deal than standard variable-rate – SVR – mortgages and can last for two, three, five or 10 years before moving you onto the lender’s SVR, but a few can be fixed for the whole mortgage term.

Other offset mortgage types include:

Tracker mortgage: When the interest rate is variable and follows the Bank of England base rate

Discount mortgage: When you’re given a set discount on the lender’s SVR

These deals often last for two years before you move onto the SVR, but you can also choose deals that last the whole term. SVR mortgages are also available for the whole term and can be more flexible than other mortgage types.

Some deals will allow you to offset your current account as well as your savings account. You may also be able to link your cash ISA, if you have one. The more savings accounts you can link to your mortgage, the harder your cash will be working to reduce your debt.

Your savings and mortgage will have to be with the same provider to benefit from an offset mortgage – you won’t be able to link a savings or current account to your mortgage if it’s with a different bank or building society.

Should I put down a bigger deposit instead of offsetting?

If you have savings, you could consider using them to put down a bigger deposit instead of keeping them in an offset account, so your mortgage is smaller. With a bigger deposit, you may also be offered lower interest rates by lenders.

However, an offset mortgage means you will always have access to your money if you need it. Offsetting might be a better option if you think you might need some spare cash in the future.

Can I get a buy-to-let offset mortgage?

Some lenders will offer an offset mortgage on a buy-to-let property. Since 2017, changes in the law have meant that landlords can no longer deduct interest payments from their tax bills, so offset mortgages may be a good option if you have a buy-to-let mortgage and want to reduce your costs.

Can I get an offset remortgage?

If you already have a mortgage and want to switch to an offset mortgage deal, it’s possible to remortgage. Keep in mind, though, that you may have to pay early repayment fees if you leave your current mortgage early.

What are the advantages of offset mortgages?

The main advantages of having an offset mortgage include:

- You can choose to reduce your monthly payments

- An offset mortgage deducts more interest than you’d usually gain on your savings, which means your money does more for you every month

- Offset mortgages have tax benefits. Because your savings are working to pay off your mortgage instead of gaining interest, they will no longer be taxed – even as they save you money every month

- You could also overpay each month, which means you pay it off sooner

- In most cases you can still access your savings account, making your finances more flexible

- Some offset mortgages allow you to use your current account as well as your savings account

- It can be a good way to help a family member get on the property ladder, as some lenders will allow you to offset your savings against someone else’s mortgage

What are the disadvantages of offset mortgages?

- Some of the possible disadvantages of an offset mortgage include:

- Offset mortgages might be more expensive than other options depending on the value of your savings

- You won’t earn interest on your savings and/or current account

- Offsetting can give you a lower loan-to-value – LTV – than typical mortgages, which means you’ll probably need to put down a larger cash deposit

- There is no rule for how much you should have in savings to make an offset the best option – it will depend on the mortgage and savings interest rates available at the time. This means it’s always best to shop around for the best deal.

For further details and to book your FREE CONSULTATION with one of our expert Mortgage Advisers please contact us

Bristol Mortgages Online www.bristolmortgagesonline.comTel 0117 325 1511

Bath Mortgages Online www.bathmortgagesonline.comTel 01225 584 888

Exeter Mortgages Online www.exetermortgagesonline.comTel 01392 690 888

Email info@swmortgages.com

#bristolmortgagebroker #mortgageadvice #independentbroker #lifeinsurance #mortgagebroker #offsetmortgage #bathmortgagebroker #mortgageprotection, #lowinterestmortgage #incomeprotection #expertmortgageadvice #freeconsultation #remortgage #criticalillnesscover #greatbuytoletdeals #fivestarservice #highlyrecommended #topmortgagebroker #movinghouse #remortgage