What do Landlords need to do to meet the upcoming EPC Requirements?

Domestic private rented property: minimum energy efficiency standard - landlord guidance.

All the Mortgage Advisers at Bristol, Weston, Bath and Exeter Mortgages Online have expert knowledge of the Buy to Let mortgage market. Many of the mortgage options available to investors are only available through lenders that only deal with intermediaries like ourselves.

Our Advisers will be delighted to quote you for your mortgage or remortgage requirements, please see our contact details below.

There are many changes that are coming into effect from 2025 and we hope this article will give you some useful information.

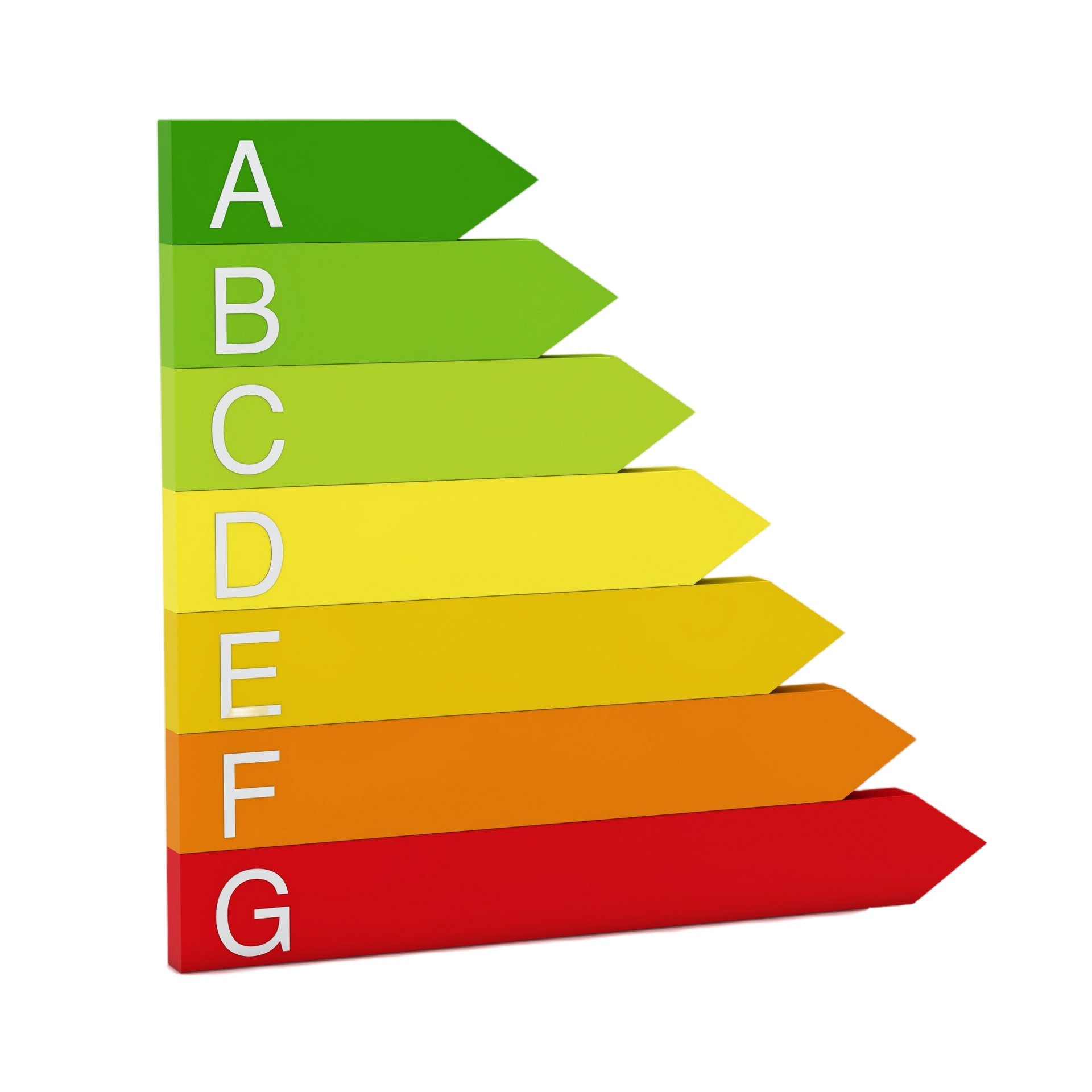

Guidance for landlords of domestic private rented property on how to comply with the 2018 ‘Minimum Level of Energy Efficiency’ standard (EPC band E) This information has been selected from www.gov.uk/guidance/domestic-private-rented-property-minimum-energy-efficiency-standard-landlord-guidance.

This page is about domestic private rented properties. There’s different guidance for landlords of non-domestic private rented properties.

Find out if your property is covered by the Regulations

The Domestic Minimum Energy Efficiency Standard (MEES) Regulations set a minimum energy efficiency level for domestic private rented properties.

The Regulations apply to all domestic private rented properties that are:

- let on specific types of tenancy agreement

- legally required to have an Energy Performance Certificate (EPC)

Answer these questions to find out whether your property is covered by the Regulations

1. Is your property let on one of the following types of domestic tenancies:

- an assured tenancy?

- a regulated tenancy?

- a domestic agricultural tenancy?

2. Is your property legally required to have an EPC?

If the property you let has been marketed for sale or let, or modified, in the past 10 years then it will probably be legally required to have an EPC.

If you answered Yes to both these questions, and your property has an EPC rating of F or G, you must take appropriate steps to comply with the requirements of the MEES Regulations. We explain how to do this below

When you need to take action to improve your property to EPC E

The Government have published a very detailed webpage, detailing all the requirements, funding options and potential pay-back periods for any investments needed to meet the required EPC standards. Please click on the link below.

Contact Us

For further details about the mortgage and protection products we offer as a fully independent mortgage broker, or any other mortgage information, book your FREE CONSULTATION with one of our expert Mortgage and Protection Advisers.

Bristol Mortgages Online www.bristolmortgagesonline.com Tel 0117 325 1511

Bath Mortgages Online www.bathmortgagesonline.com Tel 01225 584 888

Weston Mortgages Online www.westonmortgagesonline.com Tel 01934 442 023

Exeter Mortgages Online www.exetermortgagesonline.com Tel 01392 690 888