Help to Buy Equity Loan & Shared Ownership

Caz Blake-Symes • July 20, 2020

Call us today for more information.

The Help to Buy Scheme

You only need a 5% deposit thanks to Help to Buy, and with the recent changes to Stamp Duty, it is so much easier to get the home you want for less. Start your search now and Contact Us today for help with financing your purchase.

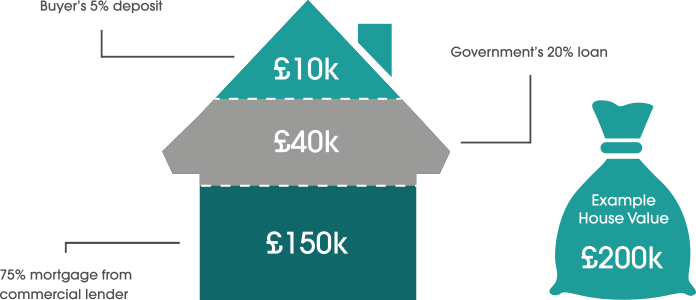

Help to Buy Equity Loan

- With an Equity Loan the Government lends you up to 20% of the cost of your newly built home, so you will only need a 5% cash deposit and a 75% mortgage to make up the rest.

- You will not be charged loan fees on the 20% loan for the first five years of owning your home.

- Equity loans are available to first time buyers as well as homeowners looking to move.

- The home you want to buy must be newly built by a Help To Buy accredited Builder, with a price tag of up to £600,000.

- You will not be able to sublet this home or enter a part exchange deal on your old home.

- You must not own any other property at the time you buy your new home with a Help to Buy: Equity Loan

In the Budget 2018 it was announced that the Help to Buy scheme would be coming to an end in March 2023. A new version of the Help to Buy scheme will operate from 1 April 2021 until 31 March 2023 which introduces changes to ensure the scheme is better targeted towards those who most need support to achieve home ownership. The key changes are:

- The scheme will only be available for first time buyers, defined as those who have not previously owned or purchased property.

- The scheme will introduce regional property price caps based on local markets, which will set the maximum price of a new build home that can be bought with Help to Buy in any region.

The regional caps are set out in table below:

Price cap for properties eligible for Help to Buy Equity Loan scheme from April 2021 to March 2023

North East £186,100

North West £224,400

Yorkshire & The Humber £228,100

East Midlands £261,900

West Midlands £255,600

East of England £407,400

London £600,000

South East £437,600

South West £349,000

Until the new scheme is introduced customers will continue to be able to purchase homes through the current Help to Buy scheme unaffected. However, all homes purchased under the current scheme will need to reach legal completion by 31 March 2021. This will influence when a builder will close for reservations using the scheme, therefore we recommend that you factor this into your plans and enquiries.

Shared Ownership

If you can’t quite afford the mortgage on 100% of a home, Help to Buy: Shared Ownership offers you the chance to buy a share of your home (between 25% and 75% of the home’s value) and pay rent on the remaining share. Later, you could buy bigger shares when you can afford to.

You could buy a home through Help to Buy: Shared Ownership in England if:

- your household earns £80,000 a year or less outside London, or your household earns £90,000 a year or less in London

- you are a first-time buyer, you used to own a home but cannot afford to buy one now or are an existing shared owner looking to move.

With Help to Buy: Shared Ownership you can buy a newly built home or an existing one through resale programmes from housing associations. You will need to take out a mortgage to pay for your share of the home’s purchase price, or fund this through your savings. Shared Ownership properties are always leasehold.

Only military personnel will be given priority over other groups through government funded shared ownership schemes. However, councils with their own shared ownership home-building programmes may have some priority groups, based on local housing needs.

People with disabilities

Home Ownership for People with Long-Term Disabilities (HOLD) can help you buy any home that is for sale on a Shared Ownership basis if you have a long-term disability. You can only apply for HOLD if the properties available through the other home ownership schemes do not meet your needs, eg you need a ground-floor property.

Older people

You can get help from another home ownership scheme called Older People’s Shared Ownership if you are aged 55 or over. It works in the same way as the general Shared Ownership scheme, but you can only buy up to 75% of your home. Once you own 75% you will not have to pay rent on the remaining share.

For further details about the service we offer as a fully independent mortgage brokers or any other mortgage information book your FREE CONSULTATION with one of our expert Mortgage Advisers please contact us.

Bristol Mortgages Online www.bristolmortgagesonline.com

Tel 0117 325 1511

Bath Mortgages Online www.bathmortgagesonline.com

Tel 01225 584 888

Exeter Mortgages Online www.exetermortgagesonline.com

Tel 01392 690 888

Email info@swmortgages.com

This month’s edition is packed full of informative articles, including

• Welcome and overview from Phil Clark

• Base rate cut to 3.75%: what could it mean for mortgages?

• Interest-Only Mortgages For Later Life.

• Need Short-Term Property Finance?

• What You Should Know About Second Charge Mortgages

• Time to Remortgag

Image courtesy of Freepix

Happy New Year!

Hope you all had a good Christmas Break and avoided the dreaded coughs and colds.

I had the opportunity over the holiday to review many of the various property and finance reports available online, as well as those to which I subscribe.

Pleasingly, the general tone is very opti

With the Budget uncertainty now lifted, buyers and sellers can return to making decisions about their next move. Removing the threat of a new annual property tax from 210,000 homes for sale will help revive market activity in higher-value areas. However, the lack of any stamp duty reform means homebuyers will continue

Please click here to see our November newsletter This month’s edition is packed full of interesting articles, including What does the Budget mean for you? Interest-Only Mortgages For Later Life. Need Short-Term Property Finance? What is the Renters’ Rights Act, and what does it mean for tenants? What You Should Know About Second Charge Mortgages Time to Remortgage? Stunning 5-star Google Reviews! Let Us Help You If You Have Adverse Credit How to Contact Us You can also read more articles on our Blog. We hope you enjoy this Newsletter. If you have any queries, please call Phil Clark on 0117 325 1511 or email info@swmortgages.com

We are thrilled to be able to offer this fantastic product through the Family Building Society.

This interest-only mortgage gives those of retirement age and beyond the opportunity to free up equity from their home, without the huge costs often faced when considering Equity Release or a Lifetime Mortgage.

Thinking about buying a new property before selling your current one? Or maybe you need quick funds to complete a renovation or secure an investment opportunity? You’re not alone. With today’s fast-moving property market, many homeowners and investors are turning to bridging loans to bridge the gap.