What does the latest interest rate rise mean for home buyers?

Adapted from a Zoopla article by Richard Donnell 4 November 2022

The Bank Rate is up by 0.75% but the outlook for mortgage rates is unchanged, with the likelihood borrowing costs will be lower by the year end.

Key takeaways

- Bank of England pushes Bank Rate to 3% but outlook for mortgages improves (slightly)

- Would-be movers adopt a wait-and-see approach amid talk of a drawn-out recession

- A high proportion of buyers using cash or smaller mortgages are less exposed to higher mortgage rates

- Other buyers will adopt new strategies to buy in 2023

- Don't get caught out waiting too long: buying a home is a 3 to 9 month process and the wider economic backdrop can move fast

Bank Rate up, outlook mortgage rate improves

The Bank Rate moved 0.75% higher this week. This does not mean the average mortgage rate of 6.25% will rise to 7%, making life even harder for new home buyers.

In fact, the outlook for fixed rate mortgages has improved off the back of the Bank of England's increase. This is great news but home buyers using a mortgage should still expect to pay higher mortgage rates than in the recent past.

The cost of fixed rate mortgages, used by 9 in 10 borrowers, is based on the how money markets expect the cost of Government borrowing to change over time. The Bank of England is acting more aggressively now to control inflation and hoping that they can reduce interest rates more quickly later in 2023. The Governor has also suggested financial markets are over-estimating the outlook for borrowing costs.

The all-important money market benchmark that underpins 5 year mortgage rates continues to fall from its high, just after the mini budget when lenders pulled mortgages products and pushed mortgage rates much higher. It has fallen over 1.25% in recent weeks and currently points towards mortgage rates of just over 5% later this year.

Home buyers adopt wait-and-see approach

These are uncertain times for everyone in the UK. Higher interest rates and talk of a drawn-out recession are not the backdrop to build confidence in making big home move decisions.

We have seen new buyer demand continue to fall - down almost 40% since the mini budget - as those without cheap mortgages or in the process of buying a home step back from the market. It is a uniform picture across the country. It mirrors what we tend to see at the end of November as the market slows in the run up to Christmas and the New Year.

How might buyers adapt in 2023?

5% mortgage rates are still much more than borrowers were paying a year ago and will dent home buyer demand in 2023. However, the impact of higher borrowing cost is far from equal and we expect some would-be home buyers to shift strategies.

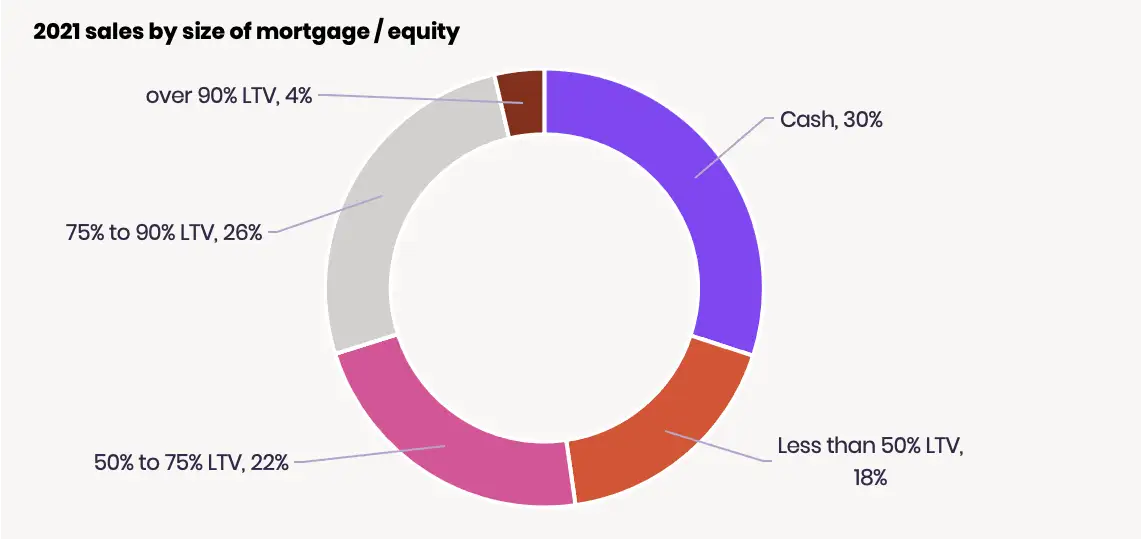

30% of home buyers use cash and a further 18% use smaller sized loans, groups that will be less affected by higher borrowing costs.

NewThe pandemic and working from home means more buyers might look to move further, seeking out better value for money using a smaller mortgage. Others may look to move and transfer or 'port' their current mortgage to their new home without taking on any more debt.

First time buyers and those looking to take out big mortgages to trade up to a bigger homes will be more affected. First time buyers often sit at the bottom of many chains of housing sales which could have a wider impact.

Outside South East England, many first time buyers have been taking advantage of lower borrowing costs and buying larger 3 bedroom homes. There is scope for them look at smaller homes and we will have to see whether they are willing to compromise on space in the face of higher mortgage rates.

Don't stop your planning of you want to move

For those serious about moving in 2023, it's important not to stop all activities. Buying a home is a 3 to 9 month process and the wider economic backdrop can move fast.

With the pressure on budgets for what you can afford, we would encourage buyers to consider other markets and areas that might offer what they need at a lower price point. Do your research and go and visit and speak to local agents who may be able to give you the inside story into local areas.

The cost of mortgages will be in flux over the coming months and lenders will be changing the product range and pricing, so stay in touch with the team at Bristol, Bath and Exeter Mortgages Online and lender to keep on top of the options available.

It's going to be a bumpy ride for the next few months but with improved planning and preparation there are still options to find that next home.

If you would like to talk to one of our expert Mortgage Advisers about remortgaging, moving house or getting on the property ladder please contact us today.

For further details about the services we offer as a fully independent mortgage broker or any other mortgage information book your FREE CONSULTATION with one of our expert Mortgage Advisers.

Bristol Mortgages Online www.bristolmortgagesonline.com Tel 0117 325 1511

Bath Mortgages Online www.bathmortgagesonline.com Tel 01225 584 888

Exeter Mortgages Online www.exetermortgagesonline.com Tel 01392 690 888

Email info@swmortgages.com

#bristolmortgagebroker #bestmortgageadvice #bristolmortgageadviser,#expertmortgageadvice

#independentmortgagebroker #bestmortgagedeals #firsttimebuyermortgage #bestremortgagedeal

#freemortgageconsultation #bestmortgagebroker #buytoletmortgage #investmentmortgage

#hmomortgage #highlyratedmortgagebroker #fivestarrated #googleverified #movetobristol

#endoffixedterm #besttimetoremortgage #earlyredemptionfee #ERC #guarantormortgage

#jointborrowersoleproprietermortgage #affordability #stresstest#bestbroker#stampduty